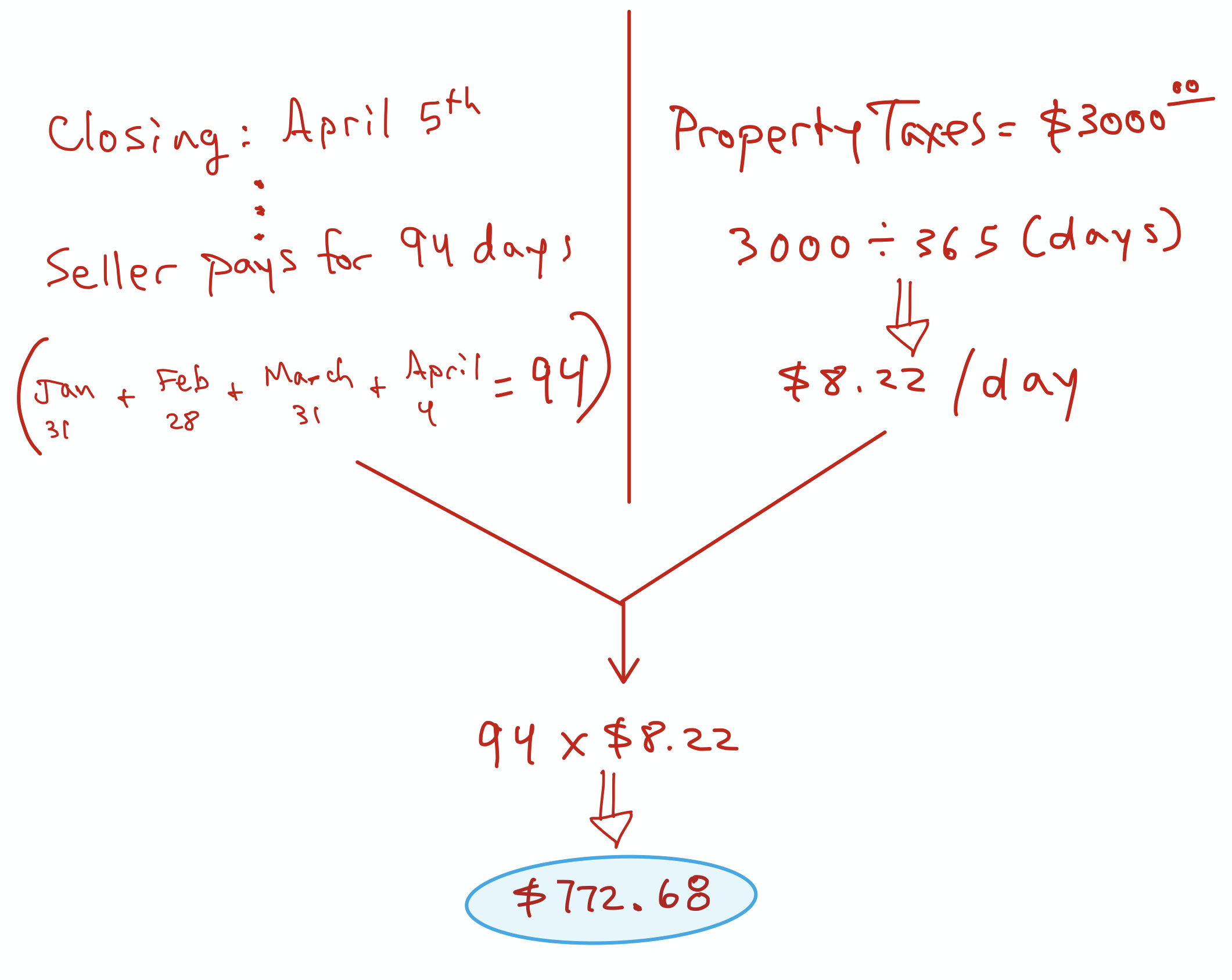

Property taxes are paid in arrears, meaning they are due the year after they accrue. As a result, when you (or your mortgage company) pay property taxes for the first time, the previous owner still owes a portion of the bill. To address this, the seller provides a tax credit to the buyer at closing. On the settlement statement, this adjustment is reflected as a credit for the buyer and a debit for the seller. This ensures the buyer isn’t paying taxes for a period when they didn’t own the home. For instance, in the example below, the buyer would receive a $772.68 credit on their settlement statement.

Property Taxes at Closing: What You Need to Know

by Devin | Sep 16, 2020 | Buyers, Educate, Sellers, The Latest | 0 comments