We have worked with many buyers in the past (often first or second-time homebuyers) who have wanted to purchase a home in need of a little work. Buying a home at a price under market value, or buying a home in an area that would, if it were in better shape, otherwise be unattainable, is certainly wise — but one problem often arises. The rub comes when the buyer realizes they may not have enough cash leftover (after they close) to put into the improvements they were hoping to take on.

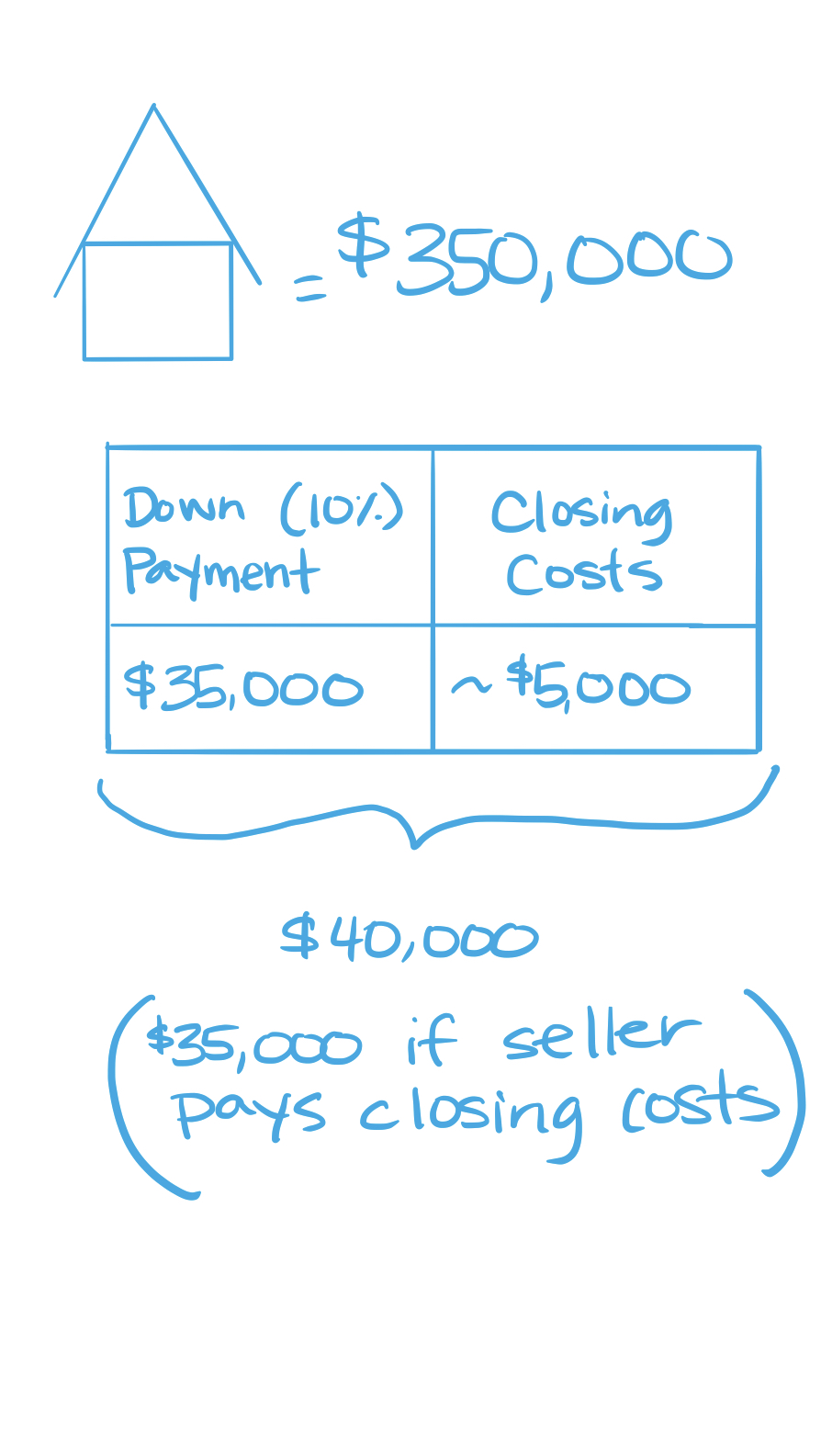

As prices continue to increase, the money needed for a down payment and loan closing costs has also gone up. It can take some time to save enough money for these minimum expenses, let alone additional money for improvements and repairs. One possible way to preserve cash is to ask the seller to pay for your closing costs. Closing costs on a $400,000 loan can be $5000 or more — this is money (in addition to the down payment) paid at the closing. If the market is such that you can negotiate a deal where the seller pays for your closing costs, you save $5000 in cash — which (theoretically) means you could use the saved money for improvements after you close on the home.

Yes, this may work, but, depending on the market at the time you purchase the home, the seller may not need to offer this concession. If the seller, for example, receives multiple offers, it’s not likely they will have to agree to pay for your closing costs. In a market like this, the seller will usually have the leverage in the negotiation as there will likely be another buyer who doesn’t need this same concession. The opposite could also be true, though. If the market is soft for sellers, and if there is only one buyer for a home, for example, not only is it likely the seller would be willing to cover your closing costs, but they may also be willing to complete a few repairs as part of the deal. If you’re working with a good real estate agent, they should be able to help you understand the market and what it means for the offer you write.

Yes, this may work, but, depending on the market at the time you purchase the home, the seller may not need to offer this concession. If the seller, for example, receives multiple offers, it’s not likely they will have to agree to pay for your closing costs. In a market like this, the seller will usually have the leverage in the negotiation as there will likely be another buyer who doesn’t need this same concession. The opposite could also be true, though. If the market is soft for sellers, and if there is only one buyer for a home, for example, not only is it likely the seller would be willing to cover your closing costs, but they may also be willing to complete a few repairs as part of the deal. If you’re working with a good real estate agent, they should be able to help you understand the market and what it means for the offer you write.